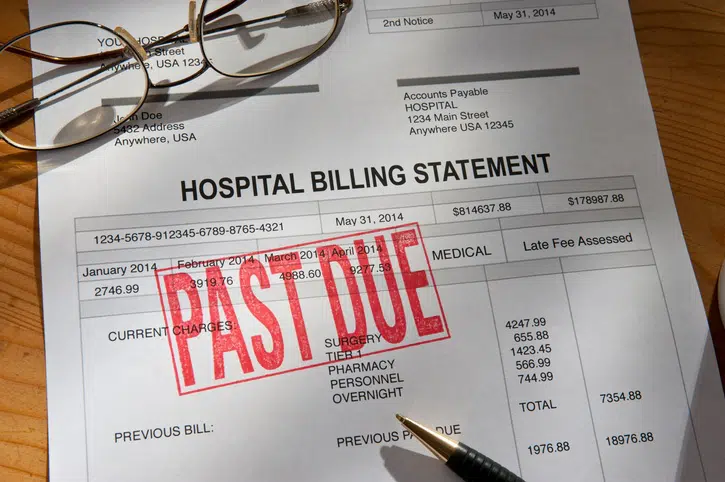

Approximately one out of five Georgia adults has medical debt collections on their credit reports. In fact, medical debt is a huge problem for about 43 million Americans, and the number one cause for bankruptcy filings in the country. Sadly, a lot of the medical debt haunting credit reports and bringing down Georgia credit scores shouldn’t even be there. This is a problem that the three major credit bureaus addressed when they recently made changes to medical debt reporting policies. Now, medical debt must stay off credit reports until it is at least six months old. Also, paid medical debt must disappear from credit reports. These new rules will help some Georgia residents with bad credit due to medical debt collections, but, unfortunately, not everyone.

Possible Good News for Georgia Consumers Who Won’t Benefit from New Medical Debt Reporting Policies

In spite of all of the hype surrounding the new medical debt reporting policies, some experts don’t believe that many consumers will benefit from the changes. In fact, in a study from FICO, data suggests that the six-month delay will help only about 200,000 people nationwide. So, if there is accuracy in the FICO study, very few Georgia consumers will see a credit score boost.

However, credit scoring models are changing too. This is because many lenders view medical debt differently than other types of debt. There is growing understanding about the rising cost of healthcare within the financial community, so newer credit scoring models treat medical debt less harshly. When the majority of lenders migrate to FICO 9 or VantageScore 4.0, Georgia consumers with legitimate medical debt should see at lease modest increases in their credit scores. Of course, this may not happen for a long time.

Why New Medical Debt Reporting Policies Make Credit Report Checking Necessary for Georgia Consumers

For Georgia residents with medical debt on their credit reports that, under the new reporting policies, should come off, diligence is necessary. Don’t simply assume that the items will disappear – check for yourself. As a matter of fact, it’s a good idea to check your credit reports at least once every 12 months. This is because mistakes and errors on consumer credit reports are incredibly common. Actually, about 80% of Georgia credit reports are flawed in some way. Common errors frequently pertain to medical debt, but creditors and credit reporting agencies also make other types of mistakes.

The Fair Credit Reporting Act (FCRA) entitles all consumers to accurate credit reports. Then, another federal statute known as the Fair and Accurate Credit Transactions Act (FACTA) makes credit reports accessible. This statute gives Georgia consumers the right to request a free copy of the credit report from each of the major credit bureaus every 12 months. Also, the easiest way to get credit reports from TransUnion, Equifax, and Experian is through www.annualcreditreport.com. Because this site is authorized by federal law, credit reports obtained here are admissible in the error-disputing process.

Speaking of disputing errors, if you find inaccuracies on any of your credit reports, call Credit Repair Lawyers of America. When you contact our firm, an experienced credit attorney will handle the dispute process for you for free. Our team offers the best legal credit repair to all Georgia residents, and we’ve never charged our clients anything out of pocket.

The Free and Legal way to Get Better Credit

Don’t let medical debt errors or other mistakes on your credit reports bring your credit score down. At Credit Repair Lawyers of America, we’ve been cleaning up credit reports for consumers since 2008 for free. How do we do it? All of our fees come from the defendants in settled cases. This is why our clients pay nothing for the work we do.

Let’s start the conversation about what we can do for your credit. Set up your free consultation today by calling Attorney Gary Nitzkin at (404) 591-6680 or sending him a message through our contact page.